Death or Taxes

California's proposed billionaire wealth tax is a step in the right direction. But we can do better.

A lot has happened in the past few days — Powell, Iran, gold, and more. We’ll be discussing all of these stories this week on the podcast. But for today’s newsletter I want to talk about something else: billionaires. Specifically, how to tax them.

You might have heard about California’s new billionaire wealth tax. The proposal would levy a 5% tax on the wealth of California’s billionaires, raising roughly $100 billion for social services. Supporters say it’s necessary to fight inequality. Detractors say it’s a step towards communism.

If you listen to the pod, you know I think wealth inequality is the number-one problem in America. America has a lot of problems, so that’s saying something. However, I also think this tax is a bad idea. Not because it’s “communist” or “collectivist,” but because it’s poorly designed and destined for failure. In this post I’ll explain why, and offer an alternative. But first, let’s quickly review how we got here.

The Numbers

If you weren’t already aware of how bad inequality has gotten in America, here are the numbers:

The top 19 households control roughly 2% of all household wealth in America. In the past forty years that number has risen twenty-fold, and has never been higher. Zooming out, the top 1% now command roughly a third of the nation’s wealth. That number has also never been higher. Meanwhile, the bottom 50% of Americans control only 3% of household wealth, which means that 19 households have roughly as much money as 65 million households. This is an unprecedented gap, usually more characteristic of third-world nations.

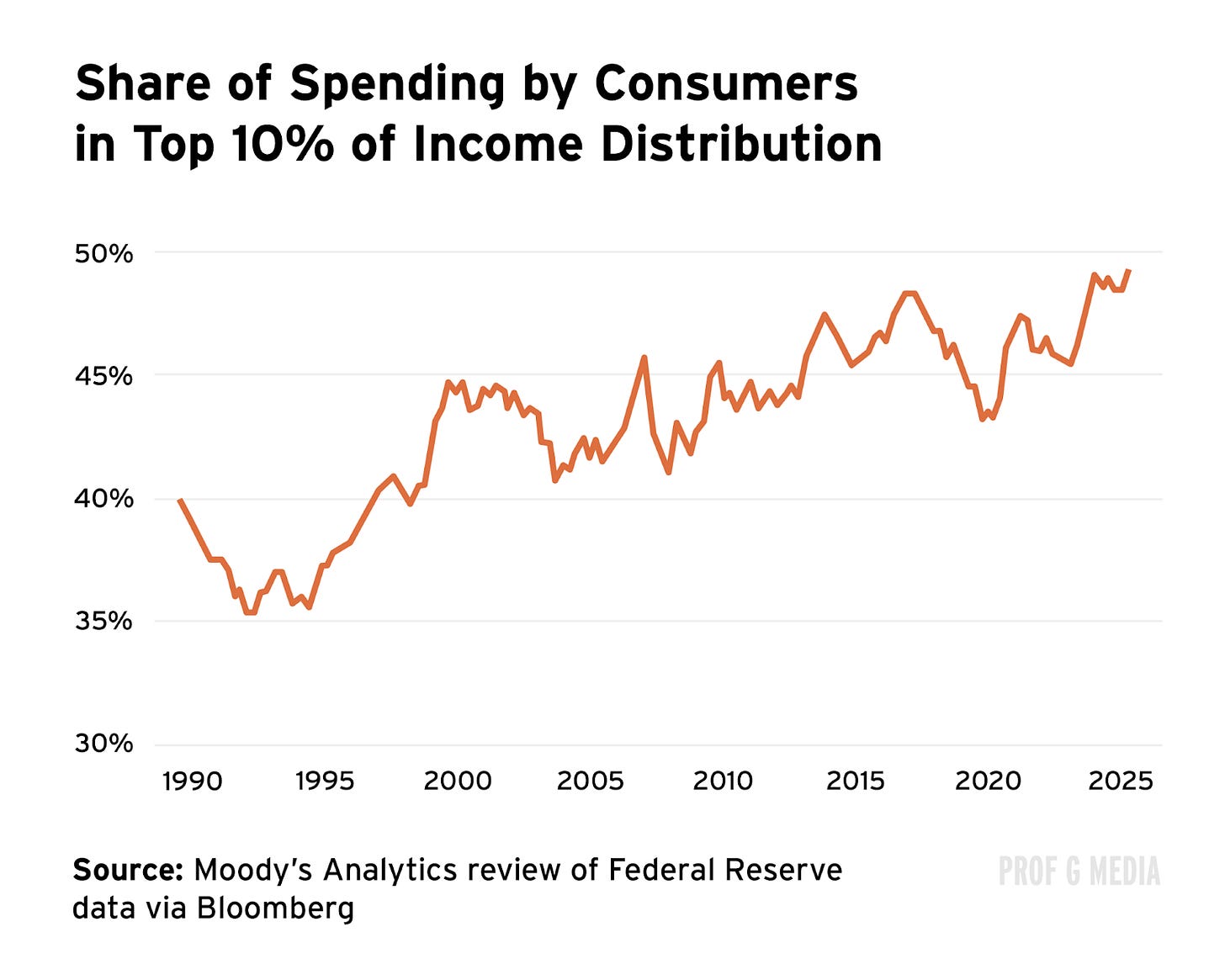

Beyond net worth, the disparity is also affecting the everyday economy. The top 10% now account for roughly half of all consumer spending in America. Again, this number has never been higher. Meanwhile the top 3% make up roughly a quarter of all consumer spending. Also never been higher.

Some might argue this is fine because “the pie is bigger.” I would remind them that despite being the wealthiest nation in the world (and one of the wealthiest in history), one in 10 Americans still live below the federal poverty line — and, as Michael Green told us on the podcast, that’s probably undercutting it.

So picture this: On the one hand, Americans are buying boats so big they require the dismantling of 100-year-old bridges. On the other hand, homelessness is at record highs and 13% of children live in poverty. Raise your hand if you’re OK with this.

Get Real

I hereby remove all appeal to ethics or fairness. I will consider only what is likely. History tells us this path leads to violence, conflict, and civil war. We saw it in Germany in the 16th century. We saw it in France in the 18th century. We saw it in Russia in the 20th century. We’ve seen this movie plenty of times before and it doesn’t end well.

To avoid our fate, we must rebalance the system. The only peaceful option is taxation.

Death or Taxes

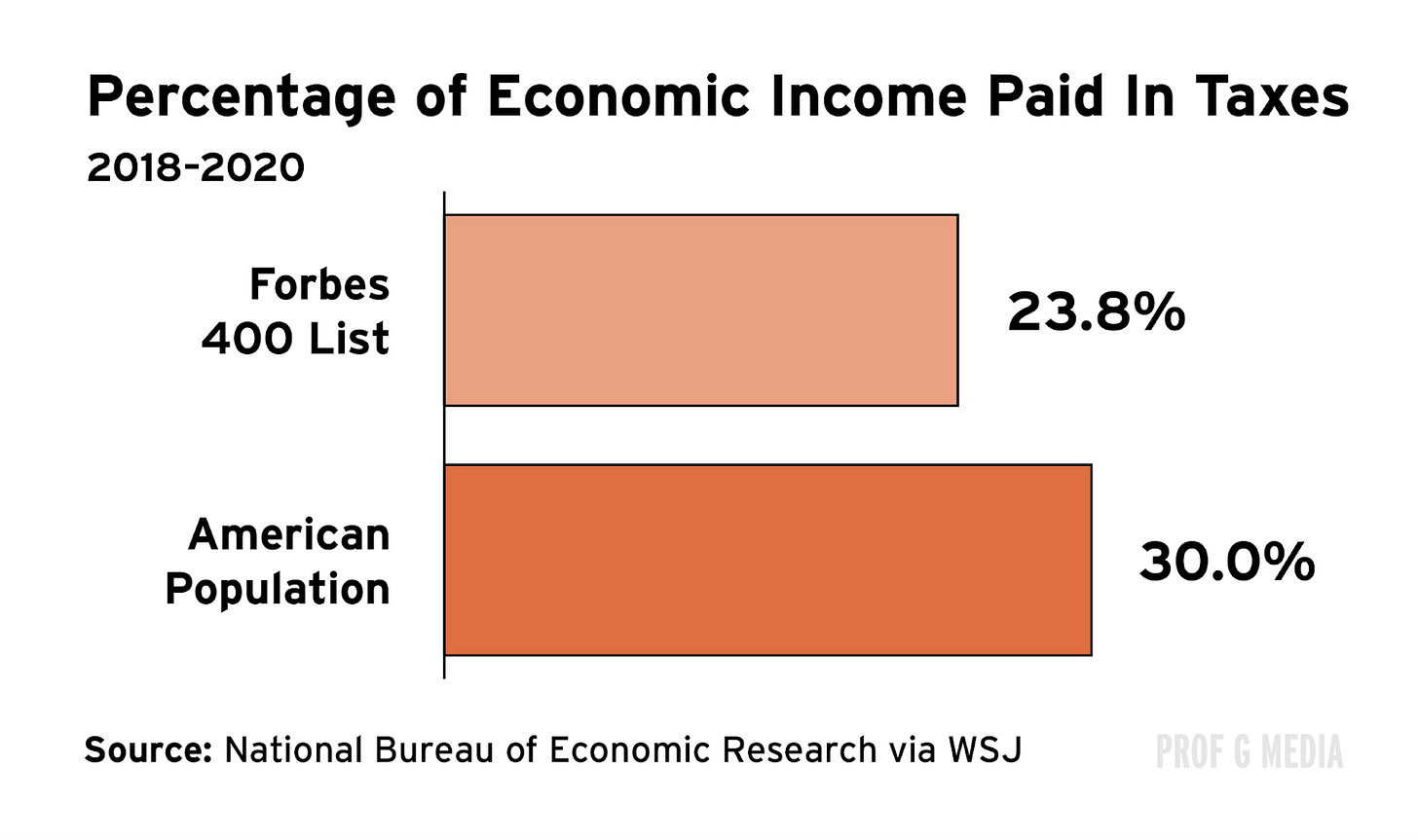

Billionaires must be taxed, full stop. I’d feel less strongly about this if billionaires already paid their fair share, but they don’t. Americans pay an average effective tax rate of 30%. Among the 400 wealthiest, it’s 24%. This is bad.

So when a California ballot initiative proposes a unilateral 5% wealth tax on billionaires, my reaction is positive because it tells me we’re getting serious. In addition, I’m not someone who finds wealth taxes crazy. Some people think it’s ridiculous to tax people on the value of assets they haven’t sold. My response: What are property taxes?

However, as I said earlier, I’m not interested in what’s fair. I’m interested in what’s likely. And regardless of your views on a billionaire wealth tax, one thing is clear: This ain’t likely.

Ain’t Gunna Happen

You may not like billionaires, but they’re more powerful than you. The reason that’s relevant is because politics is about power. Which means if you want to get anything done, you must play ball with the billionaires. This is the part where you say that’s not fair. To which I say, tough. Every good politician knows this. You don’t have to pander to billionaires, but you do have to have a conversation with them.

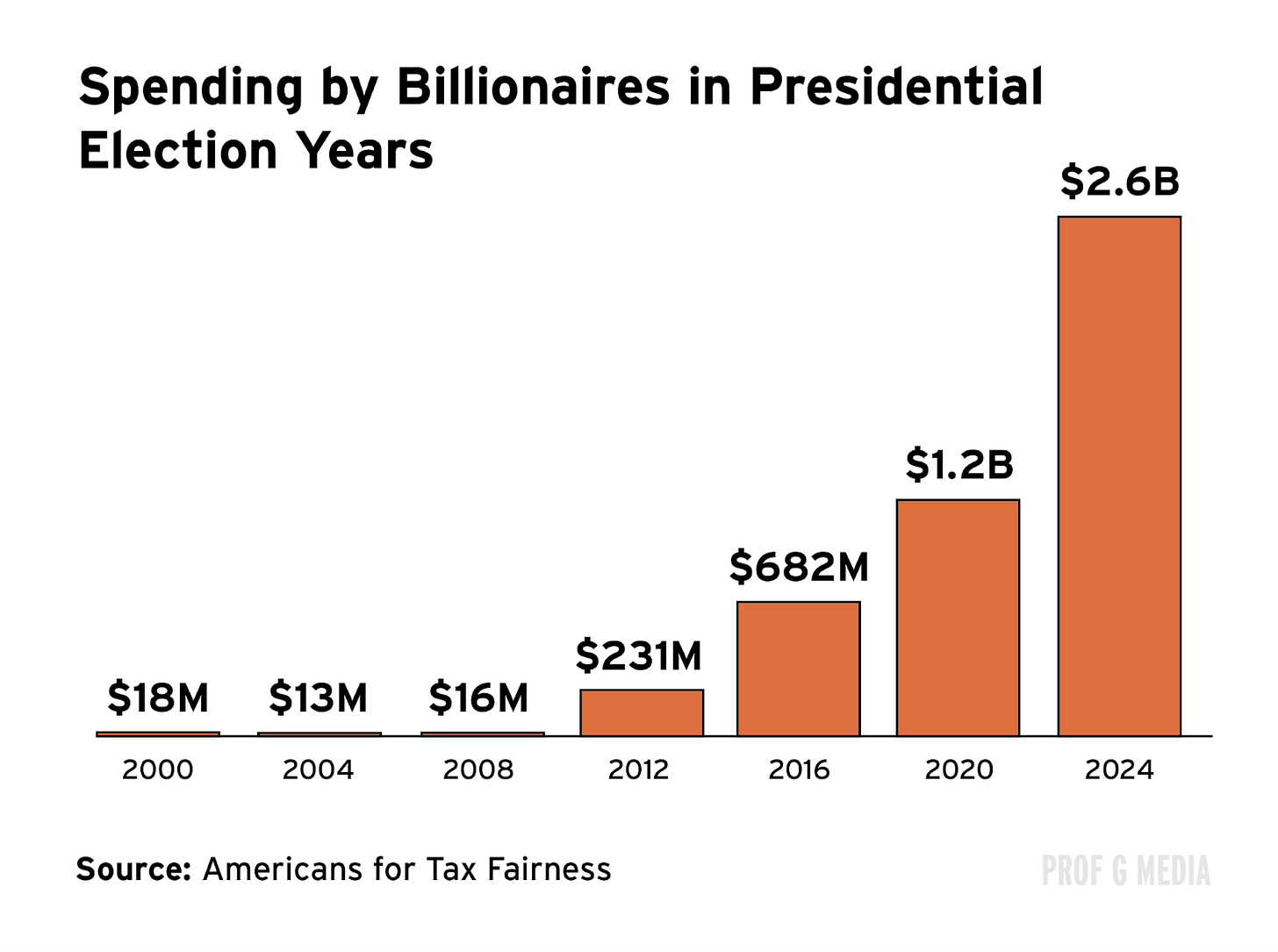

If you don’t … you will lose. History has shown this. Take California’s Proposition 15, which, despite widespread support, was struck down after business interests spent more than $70 million to prevent it. Or Seattle’s head tax, also struck down after a surge in corporate PAC spending and threats to pull donations. Or any legislation in the past fifteen years. It’s no coincidence that since the Citizens United ruling in 2010, political spending by billionaires has surged 160-fold to $2.6 billion. That’s a lot, but the ROI is larger.

The billionaire wealth tax is doomed precisely because of how much billionaires hate it. Multiple California billionaires have publicly disavowed it, many of whom have deep experience fighting in court. Musk’s lawyer Alex Spiro has already written he’s ready to mount an “expensive” and “vigorous constitutional challenge” if the measure advances. Multiple billionaires are already backing him. This is David vs. Goliath, only this time Goliath has a bazooka.

In addition, many wealth taxes have been tried before, and after lengthy legal battles, most of them have failed. France repealed its wealth tax in 2017. Sweden repealed its wealth tax in 2007. Finland repealed its wealth tax in 2006. Austria also repealed its wealth tax. So did Denmark and Ireland. Norway is one of the few places where a wealth tax persists. And although we must take with a grain of salt the billionaires’ commonly-made threat to leave, we must acknowledge that in Norway, that’s actually what happened.

Even if it does go through (it won’t), the proposal is flawed because it’s a one-time tax. It would generate a one-off lump sum of $100 billion, which might sound good until you annualize it across, call it, 15 years, and you’re left with $6.5 billion per year. That’s not nothing, but it’s also only 2% of California’s annual budget. We can do better.

The Solution

The reason billionaires pay proportionally less in taxes is because they rarely experience taxable events. Instead, they hold onto their assets forever (which rise in value) and they never sell. Taxes are paid when you sell your stock. If you never sell, you never trigger a taxable event.

This is a great strategy, until you want to buy something. You can’t buy a Gucci purse with Google stock (yet) — you have to pay with cash. So where do you get the cash? This is where the dirty secret comes in: Instead of selling their stock, rich people borrow against their stock (usually at an extremely low rate). Borrowing is not a taxable event. Which means they can borrow and borrow and borrow, and never pay taxes.

So here’s an idea: Make borrowing a taxable event. Let the billionaires keep their assets. But if they ever want to use those assets to fund their lifestyle, they pay a tax.

Two reasons why this is a good idea: 1) It would work. Unlike a one-time wealth tax, the borrowing tax would provide a consistent stream of tax revenue. Also, lots of it: Yale Budget Lab estimates it could generate as much as $20 billion per year. And 2) Billionaires aren’t that against it. Various billionaires across the political spectrum — from Mark Cuban to Bill Ackman — have said they’re comfortable with the idea. In fact, the day after I talked about this on Prof G Markets, billionaire Chamath Palihapitiya tweeted his support for it. (Takeaway: Chamath listens to the pod.)

There are many ways you could implement a borrowing tax. You could literally treat the loan as a realization event. You could also issue a withholding tax at the time of borrowing. You could also create a flat tax on the loan. Either way it would accomplish the main objective, which is to ensure that the billionaires pay their fair share of taxes.

You might feel skeptical that someone like Bill Ackman is OK with this. I would point out, however, that 7 in 10 Americans think billionaires need to be taxed more, and more than half think billionaires are threatening democracy. In short, billionaires are becoming very unpopular. I think Bill Ackman understands this and is willing to make a concession before things get ugly.

Back To Work

There’s something uniquely awful about going back to work after Christmas break. Some combination of lethargy, hangover, and general confusion team up to make us even more unsuitable for our jobs than we already are. This week I tried to write emails, for example, and felt like this monkey.

I’m getting there though. This week I bought a physical calendar. My girlfriend and I then plotted out the next six months. We even color-coded it. Green for joint events, blue for mine, pink for hers, etc. There are few more pointless exercises than color-coding, but for some reason I liked it this time — order out of chaos, structure out of disarray. I have no idea what will happen this year, but at least I’ll know what I’m doing next week.

Until next Tuesday,

Ed

An underappreciated part of this story is that America’s wealthy once invested heavily in public infrastructure and shared systems.

Andrew Carnegie funded more than 2,500 public libraries and Rockefeller poured capital into public health and education.

Today, we’re watching Cuban and Phil Knight funnel money into NIL collectives to vault their favorite college football teams while core public systems are decaying.

Yes, inequality needs to be addressed through sensible taxation, but capital also shapes culture. When the most visible uses of wealth are private indulgence (St. Barts) rather than public goods, support for capitalism erodes.

If prominent investors want younger Americans to believe in the system again, the answer isn’t better podcasts or louder defenses of markets. It’s encouraging their peers to reinvest in the country that made their wealth possible aka make capitalism generous again.

Ed, great idea. How do you make it real? What is the next step. I borrow money to but a house. Is that taxable? I am not a billionaire but I have a large retirement account. What is the cut off point?